Because I’m more-so reading for knowledge and less-so for entertainment, remembering what I read and the information I consume is really important to me. Otherwise, why would I do it?

It blew my mind when I heard that Bill Gates is said to read about 150 pages per hour and have 90% retention. Are you kidding me? 90%!

Famed investor (and friend of Bill Gates) Warren Buffett is also rumoured to read somewhere between 500 pages per day and 500 pages per week.

I estimate I typically read about 20 to 40 pages per hour, with far less recall than Bill — although I’m working on my speed and retention.

Some Good News

The story of Bill and Warren’s reading is pretty intimidating. But there is some good news. Really good news.

According to the University of California’s R. Bohn & J. Short (2009), the average American consumed 100,000 words per day in 2008. The figure was growing quickly.

Where do we ‘consume’ these words?

By listening to others, in conversation, watching the TV, and, of course, by reading social media, newspapers and books.

If we consider an average book might have, for round figures, say, 500 words per page, that’s 200 pages of information each day.

Of course, the average person reads information at a far slower pace than his or her brain can process information — hence why most of us can easily get bored with reading. And we’re never going to stop listening to people and music just to spend that time reading.

Nonetheless, I think those ideas combine to make a very interesting observation: you may already be consuming a significant amount of information and not even realise it.

How I Remember What I Read

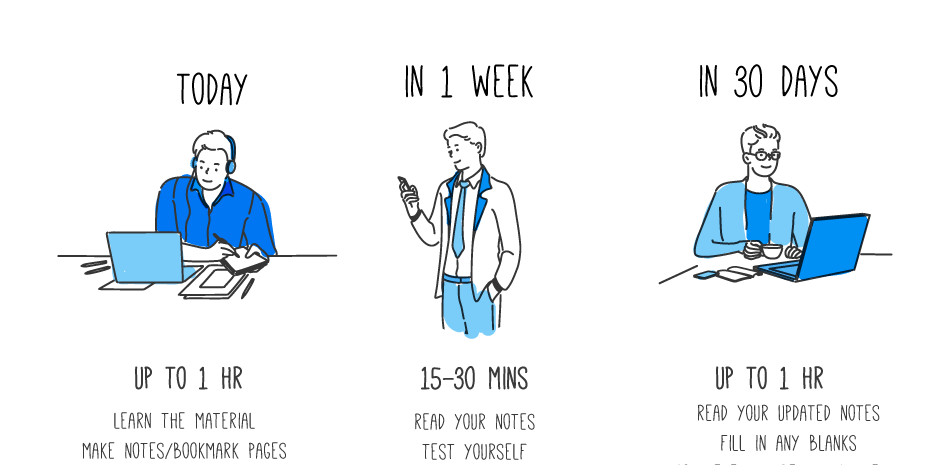

The process for remembering what I read is very simple.

I consume new material today, marking the pages with underlines, notes and marginalia; adding bookmarks and other notes to digital information I consume throughout the day.

At the end of the day, typically at night before bed, I physically write down my notes in a journal/diary that houses my information gathered on a topic. I think it’s important to write notes using pen and paper. It doesn’t scale as well as digital, but the physical act of writing something down has been shown to help with retention — which is the exact reason we review the information.

At the end of the month, I review my notes. That’s when I write a blog post about what I learned or acquired. My aim is to reinforce the encoding of the new information by building as many connections as I can to my existing knowledge. The idea here is to shift the information from short-term memory (STM) to long-term memory (LTM).

It’s a pretty simple strategy and could be nothing new to you.

There are many other strategies that I will use and adopt as time goes by. If you’re especially curious, you should read my post, “How I Read“. It fills in some additional gaps in my process.

What do you use to improve retention? Can you give me advice on how to improve my speed? Get in contact with me today.