FREE REPORT

FREE REPORT

Owen Rask's Complete Passive Income Report

Ultimate Guide for making money while you sleep

This investment report is written by Owen Rask, Founder and Chief Investment Officer at Rask and covers how to make money while you sleep, in retirement or during an early retirement. Please remember that nothing in this report is a guarantee of returns. Investing can, at times, be risky, so please read our full disclaimer at the bottom of the page before acting on the information.

Okay, where do I start…

Perhaps at the beginning.

At Rask, I’m proud to say we’ve now helped hundreds of thousands of Australians invest their time and money better through our investing articles, podcasts, memberships, national events, courses, videos and more. I think the reasons we’ve grown so fast can be put down to our investment ethos. Since 2017, we’ve been following investment principles based on simplicity, consistency, transparency and honesty.

Our investment philosophy, which we’ve had on display for all to see for a few years, is fully available online.

In this report, I aim to answer the major passive investing questions without the fluff or any of the furphys. From the start line to retirement. If you want to invest with me, book a call (see below), or become a member of Rask Core.

Is passive income… magic?

At first, passive income seems a lot like magic.

“What do you mean… I don’t need to work for this money?”

You wake up. Money. You go to sleep. Money. During the day. More money.

Passive income is money making money.

Or, perhaps as Robert Kiyosaki, author of Rich Dad, Poor Dad, might say: using your assets (e.g. share portfolio) to make more assets.

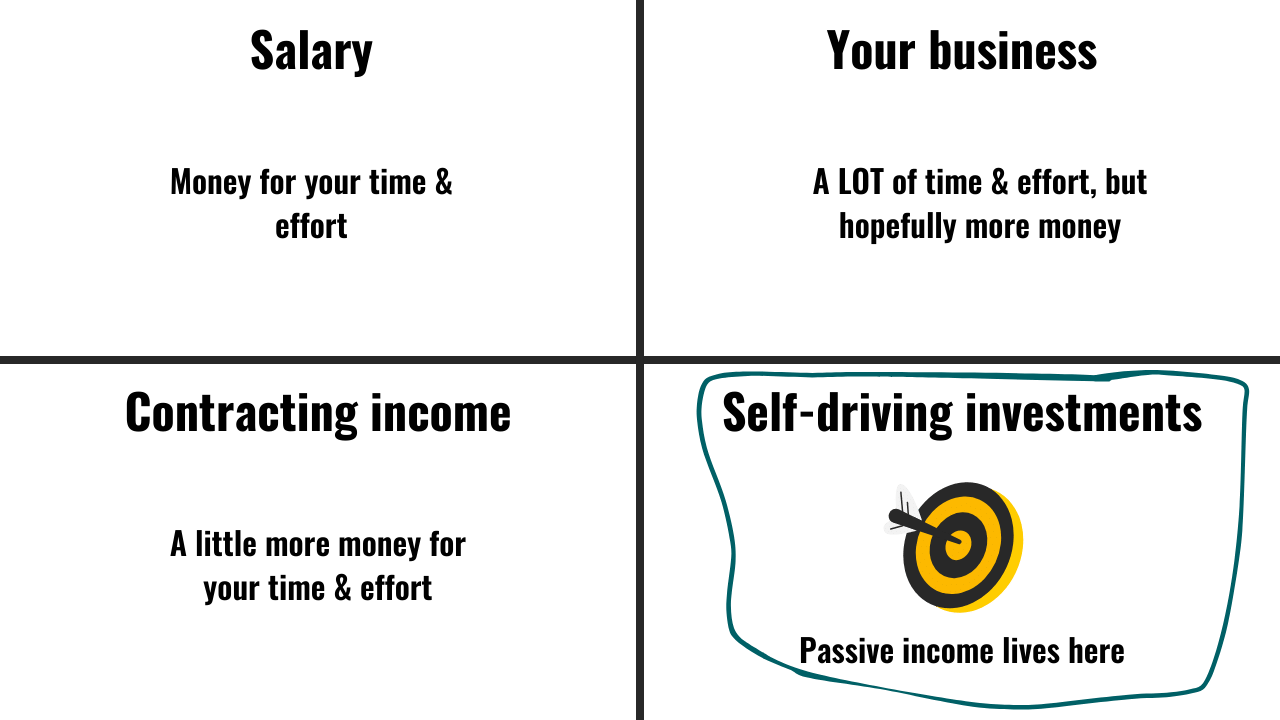

Here’s my version of Kiyosaki’s famous ‘cashflow quadrant’.

As you can see, working for an income (salary or contracting; on the left) is not really ‘passive’. It’s active income because you have to work for it. Running your own business — like I do — is not passive (trust me). It requires a lot of time and effort.

Finally, in the bottom-right corner, we have self-driving investments. This will include all of the investments that work for you, even while you sleep. Things like Australian shares, global shares, bonds, cash, some REITs & LICs and managed funds.

Property – is it passive income?

You might be inclined to include a rental property in your passive income bucket. Fair enough. It’s probably done well. But, based on feedback and talking with the Rask community, the overwhelming majority suggest it is not a passive investment — even with property managers.

However, due to the unique leverage opportunities available in property (i.e. using the bank’s money), I’d say you should at least consider property for your passive income journey. Most of the Rask community use high quality properties to accelerate their asset base. Then, after a few years, many begin strategically selling their properties and putting the equity into shares which pay better income streams.

Why invest in shares?

It’s now easier than ever to buy shares thanks to online brokers like CommSec, Pearler, Selfwealth, etc. It takes less than 5 minutes to press ‘buy’ and, usually, there are no account fees or people ‘involved’.

So, unlike a property investment (which has land tax, stamp duty, real estate, rental laws, etc.) shares are streets ahead simply because the ongoing fees and costs are so low. In other words, rather than ‘negative’ gearing, when your income doesn’t cover the costs of borrowing, a shares portfolio is almost always net cash flow positive. That’s why they work extremely well for passive income.

With shares, you have a positive and passive asset working for you. Investing in shares can be nearly fully autonomous: you simply set up the portfolio with things like ETFs (more on this in a moment), deposit regularly (or not)… then collect your dividend income.

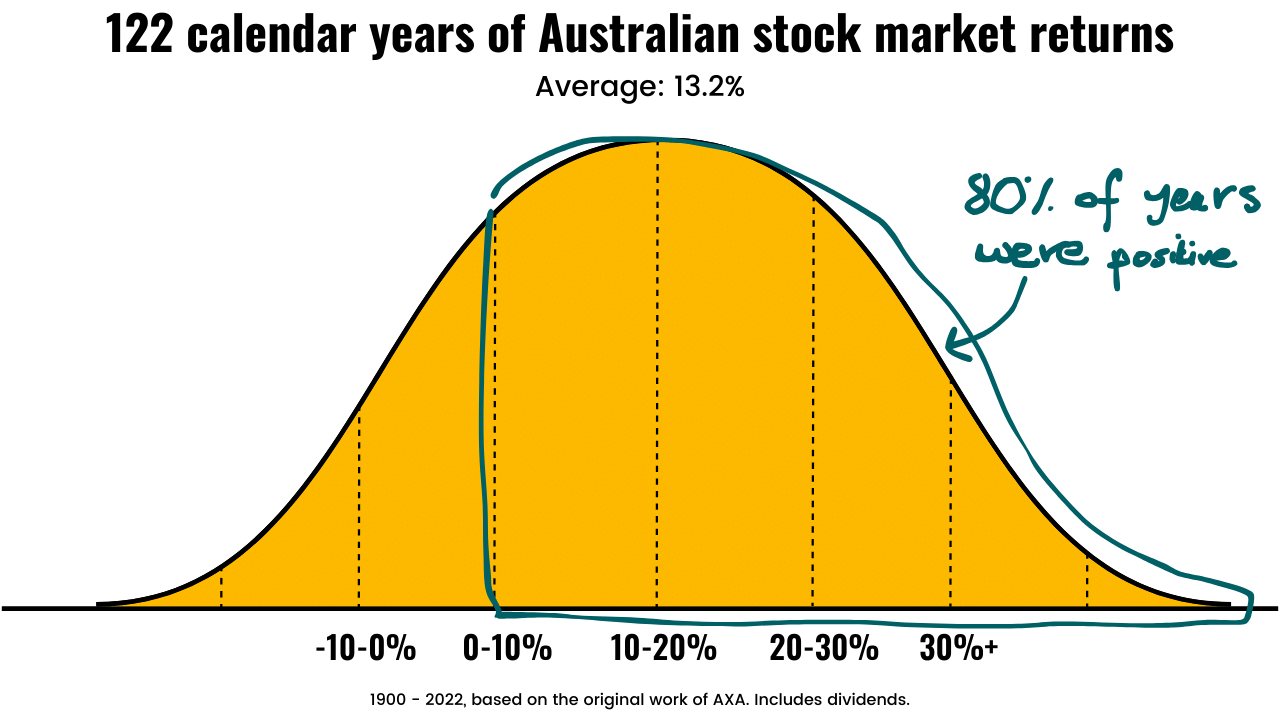

From 1900 – 2022, the average calendar year return from stocks was 13.2%. To be clear: I’m not suggesting you should expect 13% per year every year into the future. My best guess is yearly returns will come down slightly over the next 20 years.

While most people agree shares can be risky from one year to the next, I want you to take another look at the chart above. What do you notice?

Take a look at the horizontal axis and you will see that there were many more positive years than negative years in the share market. The bell curve is not ‘centred’ on zero.

Based on 122 years of data, the Australian share market has gone up 4 out of 5 years (~81% of the time).

But isn’t it risky to invest in shares?

The hardest bit of investing in shares, property or anything is the emotion.

Back in 1979, psychologists Daniel Kahneman & Amos Tversky set out to prove that humans feel the pain of loss more than the joy of gaining money. The pleasure of making $10,000 in passive income is dwarfed by the fear of losing $10,000 in income.

The thing is, while it may seem scary to lose money — I believe it’s incredibly risky not to invest in shares. Let me explain…

A problem with the finance industry is that we train our customers to think short term. Daily news bulletins, monthly inflation stats, quarterly financial reports… the list goes on. But does anyone realistically demand daily, monthly or quarterly returns?

I’ve never come across a Rask member who has told me they are investing for the next day, month or quarter. Don’t believe me?

Based on a survey of 1,143 investors in the Rask community in late 2023, approximately 9/10 said they are investing for income — during retirement or for an early retirement. In other words: to live off passive income for years, not weeks or months.

The easiest way to understand that long-term investing is not as risky as you think, is to study history.

Between January 1990 and 30 September 2023, according to Vanguard Interactive Chart data, here is the average yearly performance of key investments:

- Australian shares – 8.7%

- US shares – 10.6%

- Australian property – 7.9%

- Australian bonds – 6.7%

- Cash – 4.9%

Remember, these returns are before costs (e.g. stamp duty), taxes and inflation (5.4% in the September 2023 quarter). It’s also worth noting, that in the 1990s and 2000s, we could get bank term deposits over 7.5%… or even 10%+!

Based on this small sample of financial information, you can now see why ‘the rich get richer’. They take the short-term risks to invest in productive assets — especially shares.

~~~

Let’s now take a backward step to go forward…

Your first $100,000

Billionaire Charlie Munger once said, “the first $100,000 is the hardest”. If you’re just starting out on your journey to passive income, you should be focusing on your career/business, rather than fuss over which stocks or ETFs to buy. Think about it.

If you can get a $25,000 pay increase — and not spend it — that’s $25,000 extra you can shovel into your portfolio. That $25,000 will then pay dividends for a long, long time.

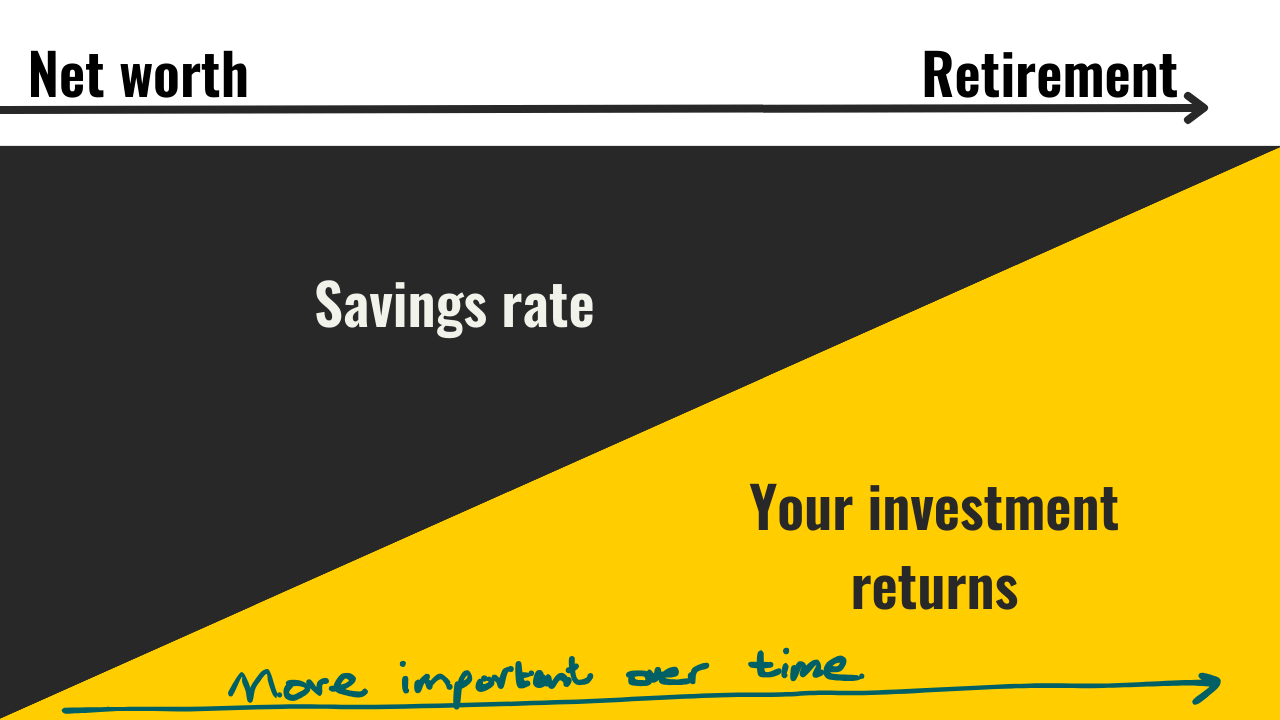

The amount you save is known as your savings rate. It equals your monthly income after tax – spending. If you want to get to $100,000 in investments, get the biggest shovel (salary) you can find and start digging (saving).

Invest in yourself, your career, your weekend job, your education. As Ben Franklin said, ‘it’ll pay the best interest’.

As you dig in and begin marching towards $100,000, follow these instructions:

- Listen to our Australian Finance Podcast every week. We answer questions and feature experts from financial advice, accounting, investing, and much more.

- Don’t overthink which ETFs you buy — buy your favourite 3-5 ETFs and do it every time you have $500 ready to invest (see below). You can always sell.

- Don’t invest any money you might need within 3 years (that’s your emergency fund) — or the money you need for a house deposit.

Coaches generally agree that it takes just 6 weeks to master a habit. I’m confident that once you reach $100,000, which may take a couple of years, the next $100k starts falling like dominoes. And the best part? You’ll start accruing passive income from the moment you first invest.

How I’d invest $1 million

Once we’re into the hundreds of thousands, or millions, it’s time to get professional. Here, my rules of investing are simple:

- Get full professional financial planning advice (and expect to pay $5-10k or more), and/or

- ‘DIY’ an ETF portfolio, using research from a trusted provider (like our analyst team at Rask Core), and/or

- Invest with someone you trust (perhaps like our Rask Invest service).

It’s okay to stuff up when you’re starting out. A 10% mistake on $100,000 is $10,000. Very manageable when you have a salary. A 10% mistake on a $2 million retirement portfolio is totally different.

Obviously, I’ll keep some of our secret sauce for Rask Invest and Rask Core (note: you can join Rask Core for just $100 upfront then $49 ongoing – cancel anytime but see below).

However, in short, here’s what I’d do with a $1 million portfolio:

- Make it diversified – I’d invest across Aussie and global shares (especially US stocks), some bonds (Aussie and global), and have a little bit in cash (either inside the portfolio or in a bank). The bonds and cash act as ‘stabilisers’ and enable you to invest more when your shares experience one of those 1-in-5 years of declines.

- Target low costs – low fees and costs mean you keep more for yourself, but please know that they are not everything. You can easily build a full portfolio for under 1% per year in fees.

- Automate as much as possible – if you receive dividends, do you need to spend it now or could you reinvest it for more income in the future? Use a dividend reinvestment plan (DRP) or dividends or, for example, if you invest with us at Rask Invest – we can do that for you automatically. Just go into the Rask Invest portal or Rask Invest app and let us know. Good share brokers and platforms (e.g. Pearler, Sharesies, etc.) allow you to automate purchases.

- Have a plan – I’ve found that investors who pick just one financial goal tend to behave much better during a market downturn. They know why they’re investing, and work backwards to make better decisions. For example, I want to own (outright) a big farm for me and my family in many years’ time. Since I know why I’m investing (long-term growth), if my shares fall this year, I won’t be bothered in the slightest because, if anything, it’s an opportunity to invest more money at lower prices.

- Invest the majority (80%+) in ETFs – using ETFs I can invest in just about any investment I could ever want (Aussie shares, global shares, bonds, cash, gold, Indian stocks, whatever!). An ETF is just a ‘basket’ of shares or bonds. Instead of picking one bond or one share to buy, I buy the entire basket with an ETF.

Why use ETFs?

In the 1980s, researchers began to explore a new but important topic – ‘is picking individual stocks the most important thing for my wealth, or should I just invest in all of them?’

What researchers found over the next couple of decades is that the most important thing any of us can do is make sure we are invested in the markets. In other words, instead of picking the individual shares one by one, just buy the entire share market! That’s where ETFs come in.

I’d be looking at ETFs like the Vanguard Australian Shares Index ETF (ASX: VAS) for Aussie shares (300 largest ASX shares), the iShares S&P 500 ETF (ASX: IVV) for the 500 largest US/global shares, iShares Core Composite Bond ETF (ASX: IAF) for bonds and so on.

Another benefit of ETFs is low costs. The average yearly fee for ETFs in Australia is around 0.5% per year. For Listed Investment Companies (LICs) is around 0.9% per year.

How much do I need?

Passive income starts at the moment you first invest. Even if you have $500 in an ETF like the Vanguard Australian Shares Index ETF (ASX: VAS) you will receive dividends, otherwise known as ‘distributions’, from the ETF provider (Vanguard). This low entry point is another wonderful feature of shares, and by extension, ETFs. You can start right now, with just about whatever you have.

For retirement, I strongly suggest getting professional advice from the age of 50-60. The reason I give this range is because some people can afford to — and probably should — retire early. I also say ’50-60′ because too many people wait until 65 to get advice and in doing so, leave the financial planner with very little time and few tools to maximise your wealth across Super contributions, business assets and an investment portfolio.

According to the official ‘standard’ on this stuff, ASFA, an Aussie couple wants around ~$70,000 per year. A single needs ~$50,000. This is for a comfortable retirement. However, these are just broad rules of thumb, which also make some assumptions.

For the Rask community, it would seem the ‘gold standard’ is around $80,000 per year for a couple. But some/many can achieve much more than that. While others don’t need as much.

The ‘rule of thumb’ for the finance industry is to retire with 70% of the salary you had while you were working. Other experts suggest retiring with at least 20x your salary (e.g. if you earned $50,000, retiring with $1 million).

Here’s how I think about it:

- Return: A balanced portfolio (60% invested in growth/40% in defence) should be able to achieve a return of 7 – 7.5% per year, on average, over 10 years.

- Inflation: things are getting more expensive, so I like to assume 3% for the cost of things going up each year. This is the upper end of the central bank’s inflation target.

- Withdrawal rate: 4% (7% – 3%)

This rule means, if we wanted to take an amount of income from our portfolio in retirement and keep the balance intact – we could pull out 4% every year. This is known as the ‘safe withdrawal rate’.

On a $1.5 million portfolio, it would mean the following:

- $105,000 return (in income and growth)

- $45,000 of inflation, and

- $60,000 is the withdrawal rate

Again, please keep this in mind: my rule assumes that at the end of the year, the portfolio would have $1.5 million + $45,000 — or $1.545 million. Most people can afford to spend more of their nest egg in retirement. Meaning, it’s okay to spend some of our portfolio over time. Especially in our 60s, since we’re not getting any younger. A European riverboat cruise is not as exciting in our 70s or 80s.

Early retirement

Early retirement is more than possible in Australia. I know plenty of people who did it in their 30s and 40s.

The blogging community, in particular those focused on financial independence (FI), has been extremely successful in demonstrating how this can be done.

If I can summarise some of the key points, follow this game plan:

- Living well within your means doesn’t mean lowering your happiness. It’s just a rearranging of priorities. Less spending now for a speedier journey towards financial independence.

- Your savings rate is the most important element.

- Use property leverage to your advantage — buying good quality property in your 20s, 30s and 40s has proven to be very successful for FI bloggers, assuming you buy the right properties.

- Make effective use of your primary residence (PPoR), which is capital gains tax (CGT) free.

- Finally, be prepared to sell the properties, remove your debts and add the money to a share portfolio primarily including ETFs.

A lot of well-known financial independence advocates have used Listed Investment Companies (LICs) like AFIC or ARGO for most of their share portfolio. I would not use LICs as a meaningful part of my portfolio unless I had a very high income / high tax rate. Compared to ETFs, LICs have higher fees, aren’t as transparent and aren’t as future-proof.

The best ETFs, like those outlined below, offer great diversification, full transparency, low fees, low turnover (good for tax) — and, yes, you still get your franking credits.

Note: If I owned LICs already, I wouldn’t necessarily sell them today. I’d just start allocating more to ETFs.

10 passive income shares on my watchlist

The list of 10 names below is a work in progress. And, please, know that you shouldn’t invest in a stock, ETF or fund unless you are comfortable you know what you are getting into. You don’t need to be a professional analyst, like me, but you should know, generally, how you expect that investment to perform over 5-10 years.

And remember, we always follow the Core and Satellite approach at Rask.

- Core – this is the larger (boring) part of a portfolio and includes investments that are low-cost, diversified and long-term focused (5-10+ years). An example might be the Vanguard Australian Shares Index ETF (ASX: VAS), which includes 300 Aussie shares, pays franking credits with its distributions and often yields around 4%. Blue chip shares, some dividend ETFs (like VHY), and 1-2 LICs might go in my Core.

- Satellite – typically the smaller part of a portfolio, the Satellite is where we keep our more speculative investments (e.g. small-cap stocks), shorter-term ‘tactical’ plays (e.g. thematic ETFs) and concentrated bets. An example might be owning shares of Xero Limited (ASX: XRO), the accounting software company which is experiencing fast revenue growth but does not pay a dividend.

Bottom line: start with your Core. Get 1-2 years of investing under your belt before trying your hand at individual stocks.

Here’s my cheat sheet to get you started with your research.

- Vanguard Australia Shares Index ETF (ASX: VAS) – Core. Invests in the largest 300 Australian shares, like BHP and CSL.

- Betashares Australia 200 ETF (ASX: A200) – Core. Invests in the largest 200 Australian shares.

- iShares S&P 500 ETF (ASX: IVV) – Core. Invests in the 500 largest US shares, such as Apple and Microsoft.

- Vanguard MSCI International Shares ETF (ASX: VGS) – Core. Invests in the largest shares from the entire world, from Nestle to Mastercard.

- iShares Core Composite Bond ETF (ASX: IAF) – Core. Invests in Australian fixed income (bonds).

- Vanguard Global Aggregate Bond Index ETF (Hedged) (ASX: VBND) – Core. Invests in global bonds.

- Betashares Australian High Interest Cash ETF (ASX: AAA) – Core. Pools investors’ money together in high interest accounts from major Aussie banks.

- Vanguard High Yield Australian Shares ETF (ASX: VHY) – Core or Satellite. Invests in ~70 dividend-paying Australian shares. In practice, I’d only use this ETF in a retirement portfolio as it has a higher turnover (causing more tax).

- Washington H. Soul Pattinson & Co. Ltd (ASX: SOL) – Core or Satellite. A large Australian company run by the Milner family that invests in other companies and pays a good dividend. Expect high amounts of volatility from this share. It would only be a small position in a portfolio I run.

- Macquarie Group (ASX: MQG) – Satellite. For a small part of a portfolio, I’d be happy to add some growth. Macquarie is a growing Australian bank that has made a profit for 50+ years in a row. Just be prepared for high amounts of volatility.

These are just 10 ideas for you to add to your watchlist. Obviously, there is a lot of overlap, so please don’t go and buy all 10 positions right now (e.g. I wouldn’t own VAS and A200 together unless there was a strong reason for it). Stop and think about how they blend together. Or see how we do it (for free – keep reading for a coupon code).

What’s a good dividend from a balanced portfolio?

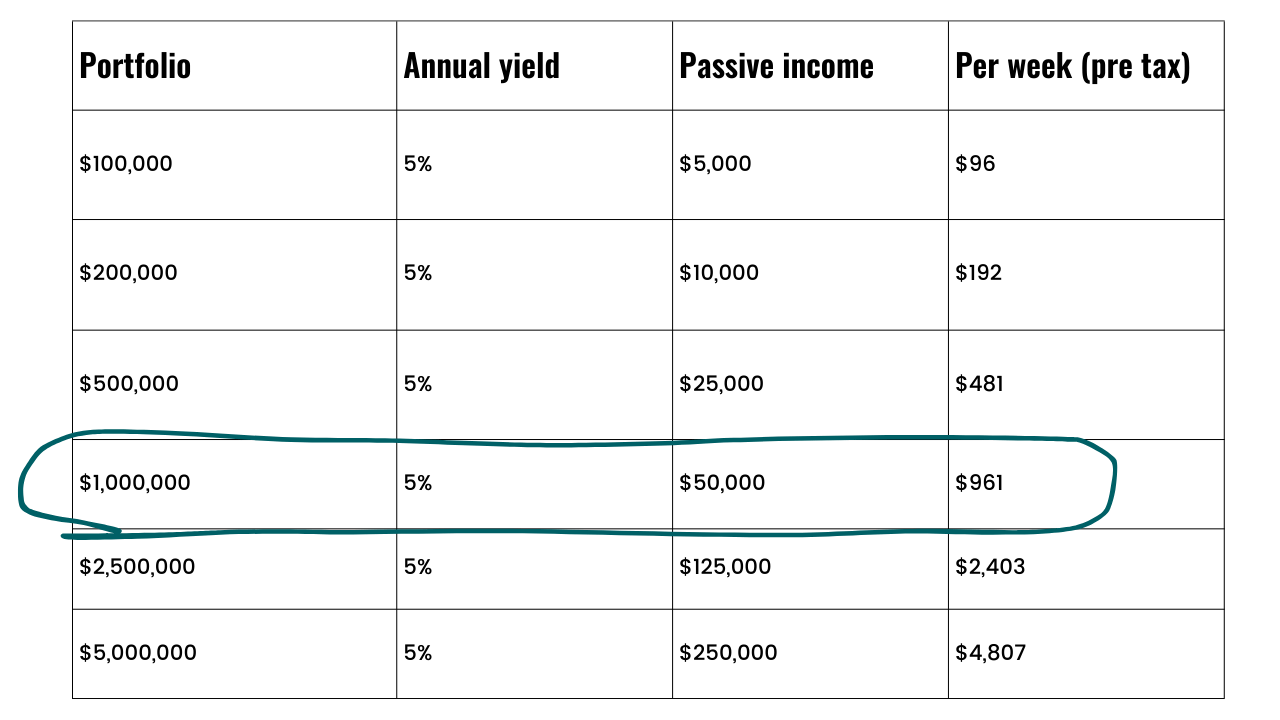

I think it’s possible to build a sustainable passive income portfolio paying 5% per year in retirement.

Note how I said “sustainable”.

If you go out simply trying to find the highest yield stocks or properties it will probably end badly. For example, companies with dividends over 10% should be approached with a skeptical eye. Just like buying property from a developer or ‘off the plan’, investments offering unrealistically high yields can quickly turn into lost capital.

Just remember, the stock market has performed at about 10% per year over the long run. And that figure includes both dividends and growth. So if you find yourself being offered 8% in dividends, you could be giving up lots of growth — and vice versa.

Of course, you can do things to improve your passive income and avoid taking excessive amounts of risk. Another free kick comes from franking credits on Australian shares, they have the effect of boosting your after-tax income, sometimes by an extra 1% or 2%.

Where to start

Okay, so you’ve read through this big report. What now?

I’ll begin sending you my weekly newsletter and invite you to listen to my favourite podcasts, take our free courses and invest with me. But if you have a couple of minutes right now, try following these steps using a piece of paper or your phone:

- Try to answer: why are you investing? Is it for passive income? To not have to work when you have kids? $1 million? What is it?

- Try to answer: How much will you need to live comfortably on passive income? (Tip: use a calculator and input, 5% x [your number] = see what income you might be able to generate).

- Try to answer: are there some duds in my portfolio? Do I want to risk doing this myself or get actual help to build an all weather portfolio?

- Decide: do you want to do it yourself or get some help?

- Make the most of Rask: Most of what we do at Rask is free, yet professional. If you’re confused, want feedback or simply are eager to learn more about investing for passive income, book a free call with me or Mitchell Sneddon, Rask’s Head of Funds Management, a professional with 15+ years investment experience. Simply select a date and time from Mitchell’s calendar, see below, that works for you and we’ll make it happen.

Book a free call with Mitchell, Rask’s Head of Funds Managment

If you plan to go it alone, take my list of 10 shares and start researching.

Again, if you want some help or guidance, consider these options:

- Use moneysmart.gov.au to find a licensed financial adviser, or use one of our trusted partners – click here for our financial advice partners.

- Take advantage of our free 30-minute portfolio discussion with Mitchell.

- Join Rask Core – I’ll waiver the $100 joining fee if you use the coupon code “passive” – click here.

- Consider investing directly with me inside Rask Invest – me and my team invest on behalf of the Rask community in diversified, low cost and transparent passive income portfolios. You simply create an account and choose the portfolio that’s right for you. Click here to join.

***

Whether you’re investing for yourself and/or your partner for passive income, early retirement, your children or something else, I think this wonderful quote is a fitting way to think about the challenge ahead:

The chains of habit are too light to be felt until they’re too heavy to be broken.

Do you have a free Rask account?

I hope you enjoyed our free investment report.

You’ll find heaps more free content and a full community of investors, inside your Rask Account.

When you get a free account you’ll be added to my newsletter and automatically get a free Rask Education account — where you can take more than 10 free courses.

Click here to get a free Rask account.

Here’s to building long-term wealth together.

Cheers!

Owen Rask

Founder, Rask

Chief Investment Officer, Rask Invest

This report was written with sensible optimism from Melbourne, Australia

GENERAL ADVICE WARNING: This free report contains general financial advice only, issued by The Rask Group Pty Ltd. The information and advice does not take into account your needs, goals or objectives, so please consider getting the advice of a licensed and trusted financial planner/adviser who can tell you if the advice/information is right for you. Investing is risky and past performance is not a guarantee of future performance. Please remember that investing in shares is risky and can result in capital loss. For more information about our advice, please find a link to our Financial Services Guide (FSG) in the footer section, below.