Australian finance podcast

The Australian Finance Podcast is one of Australia’s most successful business and finance podcasts. Brought to you by Rask Australia, this free series is hosted by Kate Campbell and Owen Raszkiewicz and offers real-world education and knowledge on finance, psychology, money and investing.

Click here to access all of the most recent episodes and show notes.

Most recent

Amazon (NASDAQ: AMZN)

April 29, 2024

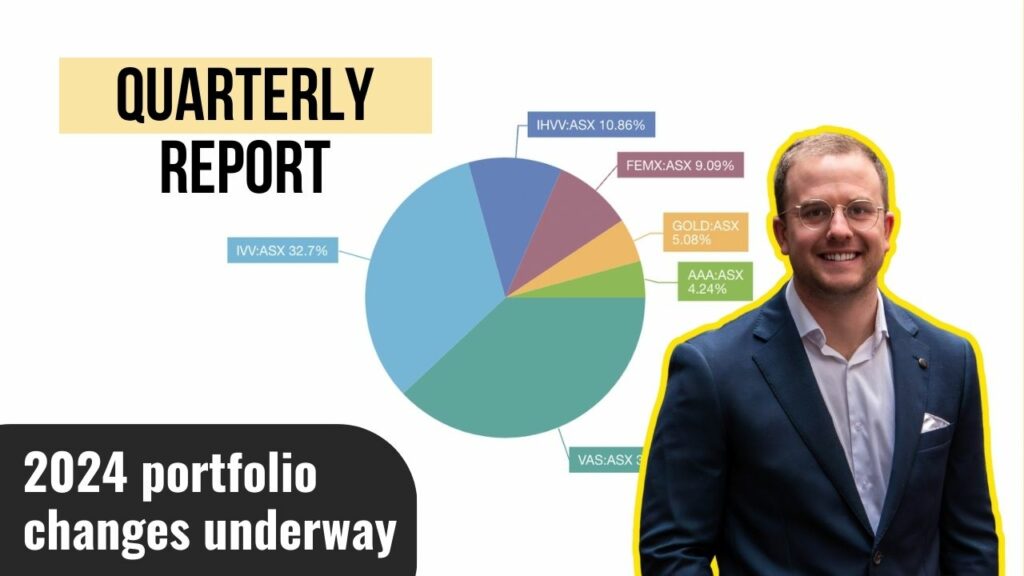

Strategy changes, portfolio changes, selling ETFs & more

January 18, 2024

My trip to China: takeaways for all investors

January 4, 2024

5 checkpoints on the path to business greatness

November 3, 2023

S4 E8. 📈 share investing made easy | starter pack

January 28, 2022