Note: part of this tutorial comes from our ETF Investing course — a course you have access to.

First things first, it’s important to know what you own and why you own it.

You wouldn’t just buy a new car by doing eeny, meeny, miny, moe.

Right?

There are more than 200 ETFs on the ASX that provide exposure to several different markets (e.g. share market, property, the bond market, term deposits, etc.). You can even invest overseas through an ETF on the Australian stock market!

Knowing what’s right for your investment portfolio when you first buy an ETF is no easy task, but don’t overthink it. You can always sell an ETF down the track.

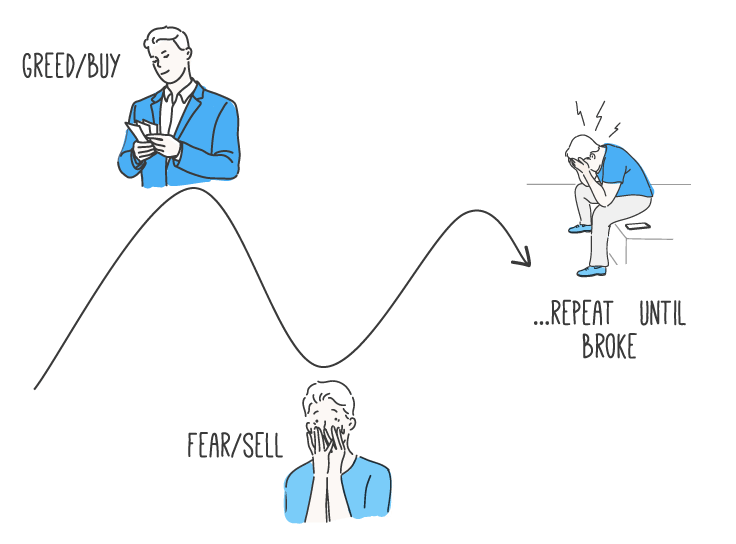

Longer-term, however, it’s important to design your portfolio to match the level of risk you’re willing to take. Don’t be fooled, everyone says they’re a long-term investor until the market falls!

4 things to know about risk & investing

We think the easiest place to start designing your portfolio is knowing what kind of investor you are, what you want from your investment portfolio and how long you have to invest.

In the following video, taken from our Super 101 course (free), I explain Investment options and provide an overview of portfolio management and risks.

1. Timeline to invest

Are you looking for long-term (10+ years) growth?

If so, you may want to focus on investing more (not all, but more) of your money in share ETFs. But remember, more growth typically means more risk.

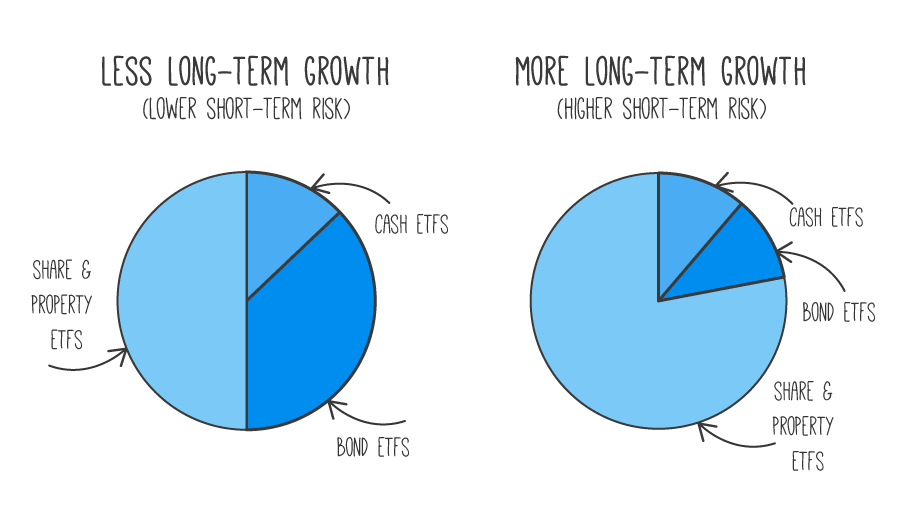

For example, if you’re seeking potential long-term growth you might choose to invest 60% or more of your portfolio in riskier assets like share ETFs and property. This is shown below on the right-hand side.

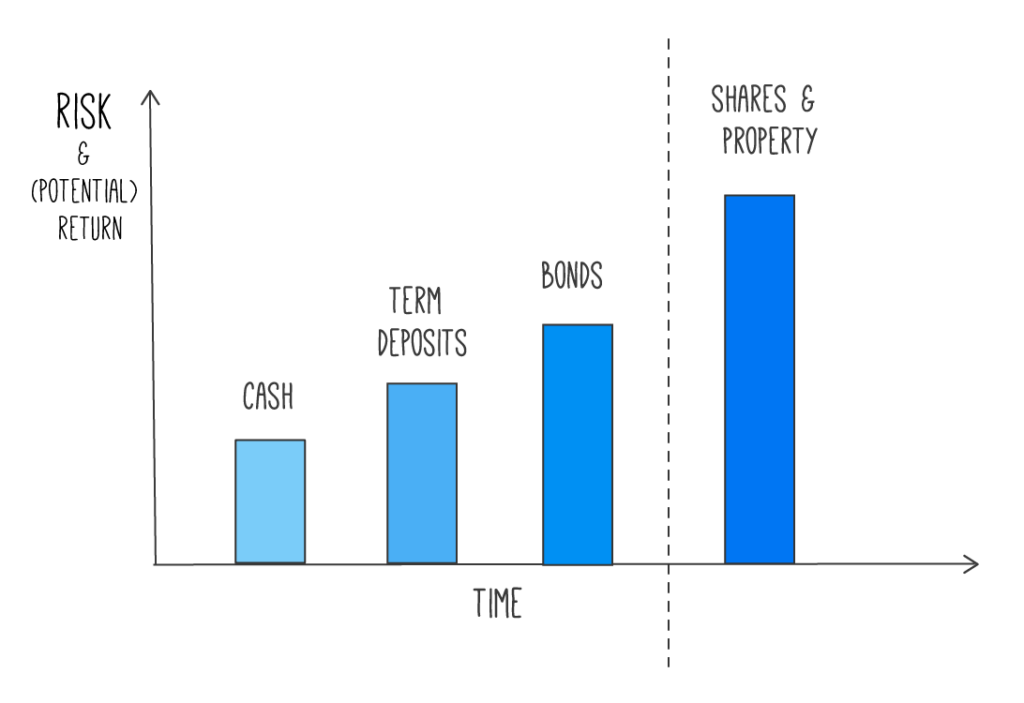

Share ETFs add risk/return to your investment portfolio whereas buying a bond ETF or carefully selected term deposits should lower the risk.

Meaning, if you’re investing for long-term growth, it’s probably not the greatest idea to have all of your money invested in cash — because the expected returns are far lower than shares.

However, if you are investing for a shorter period of time (e.g. less than 5 years), chances are, protecting your money is most important — having more cash and bond ETFs (or term deposits) might be the way to go. A less risky portfolio is shown above, on the left.

Imagine your portfolio falls 40% in the next year, how would that make you feel? Your answers to these types of questions will help you understand your risk profile, which refers to your tolerance for taking risks.

Bottom line: the longer you have to invest, the more likely it is you can take more risk.

2. Behaviour

If you’re the type of person who:

- Worries about your money every second of every day

- Checks your bank balance constantly

- Is concerned about politicians doing something dumb (note: this happens every day)

- Don’t understand how investing works, or

- Your financial position or job is not secure

You’re most likely NOT an aggressive or ‘high growth’ investor. You might be more ‘balanced’.

As a result, you may want to stick to investing in some growth/risky investments (like share ETFs) together with more ‘safe’ investments such as cash ETFs, bond ETFs and term deposits.

You might also consider speaking to a financial adviser if you’re worried about your financial situation or the risks of investing. They can help you avoid being scared when times get tough — and they always do.

Remember, everyone thinks they are a high-risk/high-reward growth investor — until the ‘risk’ part actually happens.

Again, if you’re confused, speak with a financial adviser.

3. Strategy

The most common ‘balanced’ investment strategy is a strategy that invests 60% in shares and 40% in bonds. However, for our purposes, you could swap the bond ETF for a term deposit from a bank. It’s called a sixty-forty portfolio (60/40). 60% risky. 40% less risky.

I picked the ETFs in our Rask ETF strategy so our members could mix and match the share ETFs with the bond ETFs and term deposits to get the right amount of higher risk (shares) and lower risk (bonds or term deposits) exposure. For example, 35% could be invested in an Australian shares ETF, 35% in an international shares ETF and 30% in a term deposit or bond ETF.

4. Satellite & Core

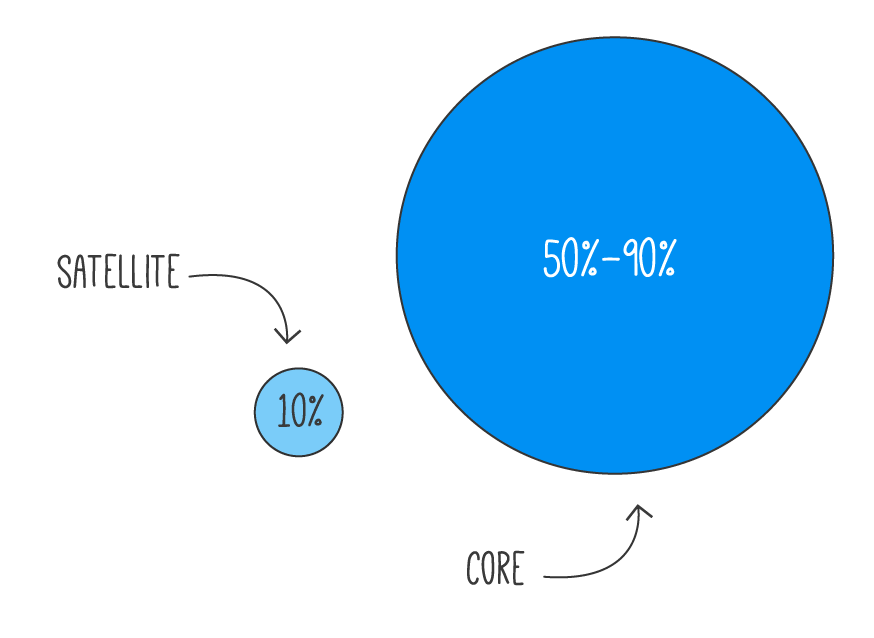

In ETF investing, there’s a strategy called core & satellite. I reckon it’s super simple — and it can be fun!

Basically, you want your core to be a balanced portfolio. These are the boring investments that you know you should be making day-in-day-out.

The core is filled with things like long-term ETFs, blue-chip shares, term deposits, bonds and property.

But let’s say you’re excited and think artificial intelligence (AI) is going to be the next thing in the world, so you want to invest in it. Well, there’s an ETF that invests in shares of global companies involved in the creation of robotics and AI.

Or maybe you think cybersecurity is becoming increasingly important in our digital world? There’s an ETF for that too.

The thing is, these ‘good ideas’ should be kept to a small part of your portfolio because their risks are not as well known. You could be right and make money, or you could be very, very wrong. We call these Tactical or “Satelite” investments.

These types of risky investments should be part of your ‘satellite’ bucket.

Alongside weird and wonderful ETFs, another type of satellite investment might be an individual share, some artwork, a collectible, Bitcoin or things that are high risk or you really don’t know much about.

Typically, satellite investments in your portfolio increase your risk so try to keep them to a minimum when you’re just starting out. For example, less than 10% of your overall portfolio.

Now what?

This tutorial on risk sounds a bit confusing, I know. But don’t worry, you’ll get the hang of it soon enough.

If you read my explainer of the Rask ETF strategy, you will know that I’ve designed the strategy to work for someone who invests, say, $1,000 every month. You will also know that I’ve picked three investments for the core, including two shares ETFs. The last investment could be a term deposit or a bond ETF.

If you follow the strategy, it means once every three months (33% of the time), there is a term deposit or bond ETF to include in the Core ETF portfolio. For some example portfolio allocations, check out our model portfolios.

If you’re worried about what your tolerance for risk might be, you could start with the simple Rask ETF strategy and build from there, or you could — and probably should — speak with a licensed financial adviser.

Always start slow, think long-term, have a good budget and know the risks you’re taking. Your future self will thank you for it.